Cap Rate Calculator: Calculate Property Cap Rates

Cap Rate for Commercial Real Estate

Capitalization rates calculate the expected annual return on investment that commercial real estate properties will generate. Cap rates can show investors how much they might expect to receive from a particular property, and thereby provide a metric for evaluating the property.

Cap rates are often looked at by lenders when financing commercial property, this is one metric that can help judge the financial health of your investment.

What is a Cap Rate for Commercial Property?

The capitalization rate of a commercial investment property represents the annual percentage return that an all-cash investment in the property would yield. The rate is essentially the inverse of a price/earnings multiple.

As a measure of return, commercial cap rate is helpful in evaluating the suitability of an investment property. It can be used to:

- Determine whether a property meets risk/return parameters

- Project expected immediate and future returns

- Screen for potentially undervalued properties

- Identify potentially overvalued properties

The cap rate of commercial real estate doesn’t capture every facet of an investment property (no single metric does), but it’s nonetheless illuminating. Because it’s simple and informative, this is one of the most widely used calculations for commercial investment properties.

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

How Do You Calculate Cap Rate for Commercial Real Estate

Calculating the Cap Rate of a Commercial Investment Property

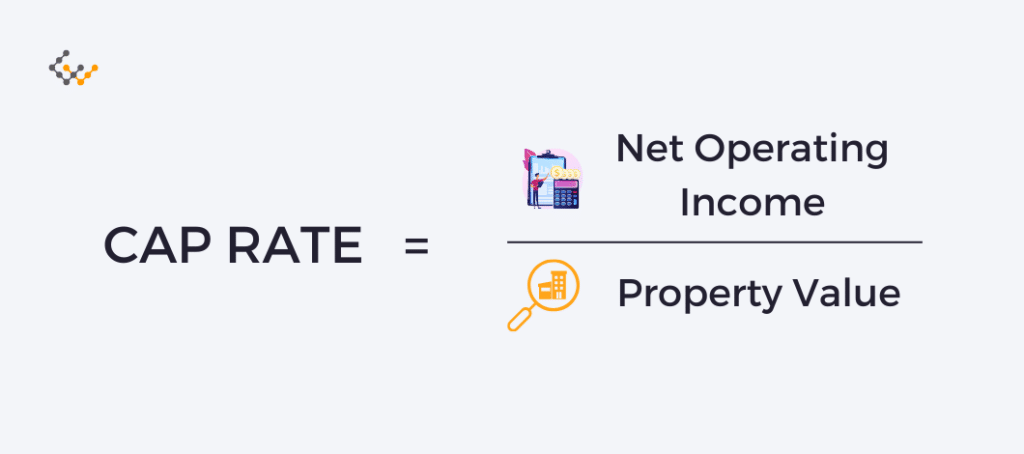

Calculating cap rate for commercial real estate is simple if you have the net operating income and the property value.

The formula is as follows:

Cap Rate = Net Operating income / Property Value

Net operating income (NOI) serves as a measure of the profitability of a property. It includes all revenues less all operating expenses. Revenues constitute lease payments, and any secondary income sources such as parking fees, vending machines and others. Operating expenses include all expenses except any capital injections and the base property value.

Usually the commercial cap rate formula is expressed as a percentage, and one year’s worth of net operating income is used. Current numbers are most often used to calculate the immediate cap rate when underwriting loans. Using projected net operating income and property value is less common, but a possible way to estimate the future returns of a property.

Inversing the Cap Rate to Determine Estimated Property Value

The commercial real estate cap rate formula can be inverted to get a rough property value estimate. The inverted formula is:

Estimated Property Value = Net Operating Income / Cap Rate

Because a commercial property’s cap rate isn’t available when inverting the formula, cap rates from comparable properties in the area can be used.

Property values derived via this method shouldn’t be considered definitive. The inverted formula can be helpful when screening investment opportunities, or when comparing the relative values of two similar opportunities. It can also provide context for other valuation methods.

What is a Good Cap Rate for Commercial Real Estate?

Because commercial real estate cap rates are directly affected by revenues, expenses and property values, they can vary significantly. What’s a good cap rate for one property class and region, might not be a good cap rate for another property class and region.

Nonetheless, general ranges for commercial property cap rates can be used as rough guides for what a good cap rate might be. Most commercial investment property cap rates range between 3 percent and 10 percent.

General Accepted Cap Rate Ranges

Allowing for variances in markets and properties, the following ranges are commonly accepted when discussing cap rates:

- Low cap rates are below 5%

- Medium cap rates range between 5 – 8%

- High cap rates are above 8%

Low cap rates shouldn’t be viewed as bad, and high cap rates shouldn’t be automatically considered good. The cap rate must be considered alongside risk.

Lower-risk properties generally have lower cap rates, and higher-risk properties generally have higher cap rates. For instance, Class A apartment complexes tend to have some of the lowest cap rates. Class B and Class C suburban hotels often have cap rates near or in the double digits.

What a good cap rate-risk combination is depends on the desired investment profile. It also depends on the comparable cap rates for similar nearby commercial real estate.

Class A, Class B and Class C Cap Rates by Market

For some more specific examples, the following rates are usually decent cap rates for Class A commercial office buildings in different markets:

- Tier I market cap rates may range from 4 – 5.25%

- Tier II market cap rates may range from 5.5 – 6.75%

- Tier III market cap rates may range from 7 – 8.5%

Good cap rates for Class B properties in the different markets might be:

- Tier I market cap rates between 6.75 – 7.5%

- Tier II market cap rates between 7 – 8%

- Tier III market cap rates of 8-10%

Class C properties would be expected to have higher cap rates, perhaps ranging between 7.5 – 10+% depending on the specific market and property.

How to Use Cap Rates in Commercial Real Estate?

Real estate investors and underwriters use cap rates for several purposes, but the percentage should only be considered for what it is.

Cap rates don’t take into account many other factors that can vastly affect a commercial real estate property’s current value and future returns. The rate doesn’t reflect occupancy rates, tenants’ creditworthiness, lease expiration periods, general property condition, major upcoming repairs, or other notable factors that ought to be taken into account.

As it is, however, cap rates are still highly useful for several different purposes. Underwriters and investors use the rate to:

- Screen:

Initially screen for promising investment opportunities.- For-sale properties that have especially low cap rights might be able to increase revenues quickly. An anchor tenant’s rent could be raised if their lease expires soon, or vacancies might be reduced by offering more favorable lease rates.

- For-sale properties that have especially high cap rates might provide above-average returns if the present risks can be mitigated. Renovating or repairing a property might make it improve its condition, or future development could improve the immediate surrounding market.

- Compare:

Cap rates of two or more similar properties can show differences in the properties’ valuations. This can show which property provides a better return on investment, which property is valued higher or lower, or which property has greater appreciation potential. - Verify:

Underwriters usually don’t rely heavily on cap rates, often considering it along with debt yield, loan to value and debt service coverage. They will frequently look at cap rate when verifying or determining a property’s approximate value, however. - Trend:

Since commercial real estate cap rates are directly influenced by property values, sudden market-wide changes in cap rates can indicate a substantial change in overall commercial property values. Drops in cap rates could indicate a quick rise in property values, which might be a bubble. Jumps in cap rates could indicate a quick decrease in property values, which might be a short-term opportunity or a long-term depressed market.