Debt Service Coverage Ratio Calculator: Determine Your DSCR

The debt service coverage ratio (DSCR) offers a key but often misunderstood tool for all commercial real estate financing parties. For instance, investors may use this formula to adjust offers, track performance, calculate profit margins, and determine when they should obtain financing or seek to refinance. In contrast, lenders employ the figure during underwriting to decide if the property earns enough income to justify the risk.

Find out how to calculate the debt service coverage ratio formula and what it means.

How to Calculate the DSCR Real Estate Ratio

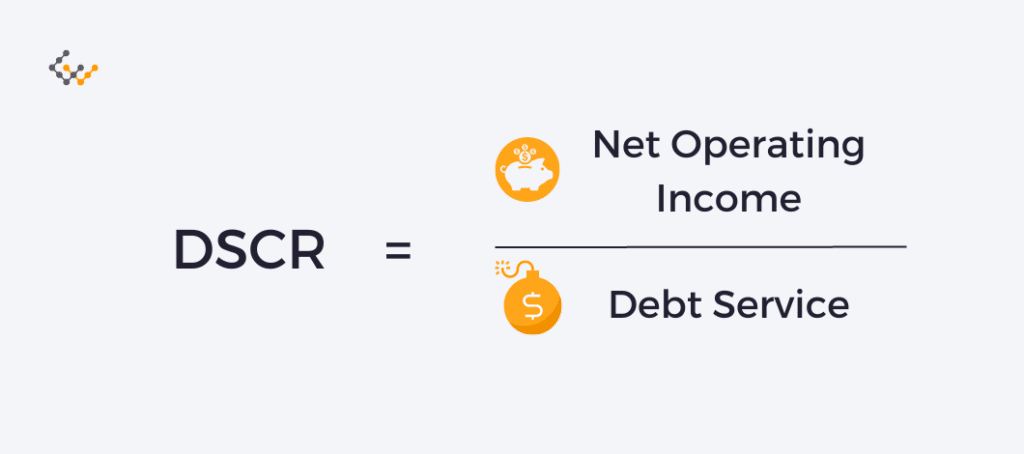

This simple formula doesn’t require a unique debt service coverage ratio calculator. The DSCR formula for real estate divides net operating income by total debt serviced.

Net operating income refers to a property’s total revenue minus its operating expenses. Examples of operating expenses include taxes, insurance, management fees, utilities, and repairs or maintenance.

Debt service coverage formula

DSCR = NOI / Debt Service

NOI: Net operating income.

Debt service: Sum of interest payments and repayment of principal.

For instance:

- A property might generate $200,000 a year in net operating income. The debt on the property for this example equals $150,000.

- Set up the debt service coverage ratio formula as 200,000 / 150,000. This figure rounds down to 1.3.

- Sometimes, lenders or investors will express the answer as 1.3X. This figure means that the net operating income could service the entire debt about 1.3 times.

How to Interpret the DSCR for Real Estate

Typically, underwriters and investors interpret any value over 1.0 as positive. In general:

- A value over 1.0 indicates that the property generates enough income to service its debt and leaves some room for profit.

- A DSCR of less than 1.0 indicates insufficient cash flow for debt servicing.

Many factors can impact DSCR. Also, it can change over time.

For instance, an effort to decrease vacancy rates may increase revenue. At the same time, repair costs may increase as the property ages. Thus, real estate investors should continue to track the DSCR to look for trends to let them know how well they’re meeting goals or what needs to improve.

Thus, a ratio just above 1.0 won’t offer much of a margin for error if income decreases or expenses increase. Therefore, a lender will probably require a higher minimum ratio to minimize risk. Similarly, investors might also decide they feel comfortable with a higher ratio to offer a bit of cushioning in case of unexpected income drops or expense spikes.

What’s A Typical Real Estate DSCR For Lenders And Investors?

Acceptable ratios may depend upon individual finance companies or investors. The type of property and anticipated risks may also impact financing decisions. In general, lenders look for a DSCR in real estate between 1.2x and 1.4x.

Stronger, more stable properties will tend to fall closer to 1.2. In contrast, properties with shorter leases or less creditworthy tenants may require higher ratios to compensate for the additional risk. Thus, property investors should seek higher profit margins to account for increased risk.

How Property Investors Can Use DSCR To Make Investment Decisions

Property investors can use this ratio to make decisions about property purchases and financing. For instance, say investors get a chance to buy a property for $150,000. Before accepting the deal, they contacted a finance company to find out they would need a minimum DSCR of 1.4. Investors can use this information to make a good decision:

Based on the past performance of this example, the investors expected a net operating income of $7,500. These investors can divide the net operating income by DSCR to learn that they need total debt servicing that does not exceed $5,357 in interest and principal. When the investors contact the lender again with this information, they learn that they would need a down payment of 30 percent to qualify for the loan.

Thus, real estate investors might consider various options. These include:

- The investors may choose to take the offer and provide the lender with the down payment.

- They might also choose to make a lower offer to reduce the down payment needed.

- They might decide the opportunity doesn’t offer enough potential gain for the risk and pass on the property.

- The investors could also shop around to see if they can find a finance company that will offer them a lower minimum DSCR.

Investors can also use this information proactively when shopping around for properties to purchase. For instance, they can use the anticipated DSCR and capital they planned to use for a down payment to find properties with a price and expected earnings that will qualify for a loan and provide adequate room for profits and a comfortable margin in case of unexpected changes in income or expenses.

The Importance Of The Debt Service Coverage Ratio Formula

The DSCR offers lenders and investors a critical but straightforward way to evaluate properties. Even better, keeping track of this value over time can help investors determine when they should consider refinancing. For instance, an increasing DSCR indicates higher profits and less risk, so lenders may offer better rates.