Yield Maintenance Calculator: Calculate Your Prepayment Fees

Commercial mortgages have numerous stipulations that help to protect the lender’s investment. One of those is a prepayment penalty called yield maintenance. Commercial lenders may use this type of penalty as a way to ensure they receive a profit from lending to the borrower.

What Is Yield Maintenance?

In commercial mortgages, yield maintenance is a type of fee paid by the borrower to the lender that enables the lender to receive compensation for the loss of interest they would have received if the loan was not paid off early. As a prepayment penalty, it helps mitigate lenders’ prepayment risk. Often, lenders include this fee as a way to discourage borrowers from paying off the loan early, which limits the lender’s access to interest.

The yield maintenance allows investors to earn the same yield as if the borrower made all of the expected mortgage payments, including investment payments from the start date through the maturity date on the commercial mortgage. When yield maintenance is a component of the mortgage, it requires that the borrower pay a rate differential between the stated loan interest rate and the current or prevailing market interest rate. This is applied to the prepaid capital that is being paid prior to the loan reaching its stated maturity.

How Does Yield Maintenance Work?

Consider yield maintenance prepayment and what it means a bit closer. When a borrower obtains a mortgage loan, the lender is paid interest for allowing the borrower to use those funds for the purchase of commercial real estate.

This is compensation for using the lender’s money. The interest expected constitutes a rate of return. The lender uses this figure to protect its earnings over a period of time. The lender expects to receive interest payments each month until the loan is expected to be paid in full.

However, if the borrower decides to pay off the loan in full before the set term, the lender loses money, and earning projects are no longer accurate. To help deter this or compensate lenders when it occurs, the mortgage contract may place a prepayment fee on loan. This fee is called the yield maintenance. When the borrower pays yield maintenance, the lender is able to obtain the original yield and, therefore, does not suffer any loss of income.

There are two portions to the yield maintenance, the loan’s unpaid principal balance as well as the prepayment penalty.

Unpaid Principal Balance

The unpaid principal balance is the amount of money remaining to be paid on the loan. For example, if a borrower obtained a $500,000 loan and over the last few years has paid off $100,000 of that amount, the unpaid principal balance is $400,000.

Prepayment Penalty

A prepayment penalty is a required fee written into the contract of a mortgage loan. This fee is paid if the borrower pays off the loan before the loan’s term maturity date. By having a prepayment penalty in place, refinancing the loan from one lender to the next is less attractive and typically is uneconomical for the borrower, thus protecting the lender’s interest earnings.

What Is the Yield Maintenance Period?

The yield maintenance period is the length of time, according to the commercial mortgage contract, that the yield maintenance fee is required to be paid.

For example, the lender may place a requirement that there is a prepayment penalty in place for the first 10 years of a 30 year loan. During that first 10 years, if the borrower pays off the loan, the yield maintenance is due. This yield maintenance prepayment penalty then discourages borrowers from taking action such as refinancing the loan and protecting the lender’s investment.

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

How Do You Calculate Yield Maintenance?

Though it is a bit challenging to do so, it is possible to follow a yield maintenance formula to determine how much this fee will be. Another option is to use a yield maintenance calculator that can handle the more complex equations.

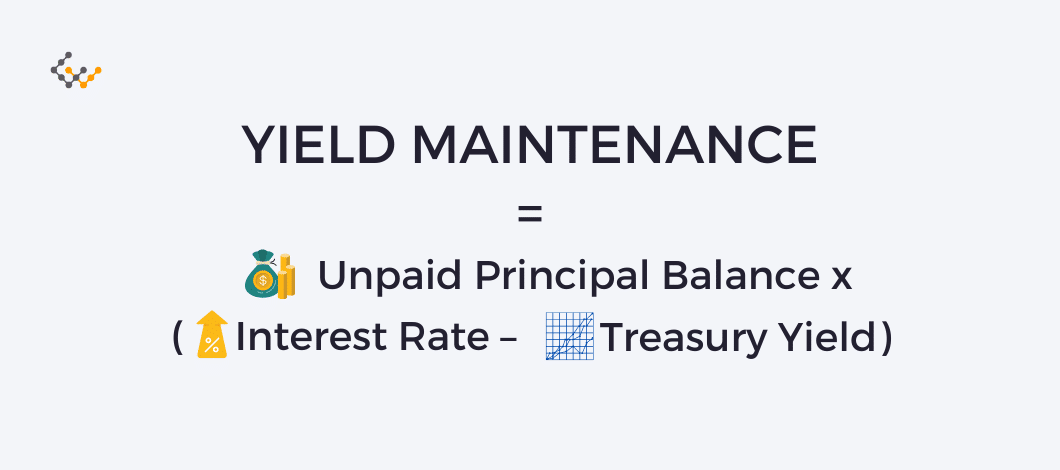

The formula is:

Present Value of the Unpaid Principal Balance multiplied by (the Interest rate – Treasury Yield) equals the Yield Maintenance.

If you would like to calculate the yield maintenance on your own, (1 – (1+r)-n/12)/r is the formula for calculating the Present Value. In this, the Treasury Yield is r, and n is the number of months.

It is typically ideal to use a calculator that is designed to provide yield maintenance based on the terms of the loan. Doing so helps to provide insight into whether or not it is financially sensible to pay off the loan early, such as obtaining a new loan (through refinancing) that offers a lower interest rate or different terms. Borrowers should take this step before they decide to pay off a commercial mortgage loan.

How Does Yield Maintenance Differ from Defeasance?

When it comes to yield maintenance vs defeasance, both allow the borrower to unencumber the commercial property, but they do so with two different processes. Yield maintenance is a term that refers to the actual prepayment of the loan. That is different from defeasance, which is the substitution of collateral as well as a successor borrower assuming the loan.

As noted, yield maintenance includes the unpaid principal balance and the prepayment penalty. This penalty is typically calculated using the current value of the remaining loan payments. There may be a small processing fee associated with the servicer, but no other transaction fees apply.

Defeasance costs are different. To determine them, the value of the portfolio of bonds (the value of those bonds is equal to the value of the remaining loan payments) as well as a transaction fee that is typically paid to more than one third party.

By comparison, then, yield maintenance tends to be a simpler route in terms of the length of time it takes as well as the overall cost.

Is Yield Maintenance Prepayment for You?

As a borrower, lowering costs and risks is typically a necessary step. Many borrowers enter into commercial loans with the intention of remaining in them until the loan is paid off or the property is sold to another owner. Yet, without considering the presence of prepayment penalties like this, it may be difficult to know just how affordable a loan can be.

For example, if a commercial property owner does not plan to maintain the property long term, a loan with a yield maintenance is going to be expensive to them should they decide to pay off the loan early. Yet, many commercial mortgages have this fee included, at least for a period of time.

For borrowers, the presence of a yield maintenance fee that is shorter, such as six months prior to the loan’s maturity, may lead to lower interest rates and fees overall. Lenders are more confident when this prepayment penalty is present in their earnings and, therefore, are likely to offer a lower interest rate. That could mean more affordability and lower closing costs for the borrower.

Yet, all borrowers must consider the risks of yield maintenance. If there is any expectation of paying off the loan earlier than the majority date, it is essential to understand the cost of any type of prepayment penalty on the loan. Otherwise, it could be a costly concern later.