What is Gross Leasable Area in Commercial Real Estate?

The size of a commercial investment property is one of the most important factors when projecting the property’s potential revenues. This is perhaps the most important factor aside from location and type of property, for size directly impacts the potential rents that a property can generate.

Specifically, investors should consider the gross leasable area (GLA) of a property when projecting rents and revenues. GLA best quantifies the space wishing a leasable building.

What is Gross Leasable Area?

Gross leasable area (GLA) measures the total floor space that could be leased within a building. It can be thought of as the potential leasable space before any common areas (e.g. entryways, lobbies, public restrooms, etc.) are built in.

In this way, GLA includes both exclusive and common spaces that tenants use. Any office space, production space, retail space, restrooms, storage, or other areas that a tenant has exclusive use of are included. So too are those entryways, lobbies, shared restrooms, and the like that all tenants use.

Select areas, such as maintenance closets and mechanical rooms, aren’t included. Elevator shafts and stairwells may or may not be included, depending on how they’re utilized.

Gross leasable area, meaning the space that can be leased, isn’t equivalent to the square footage that tenants can actually use (see Rentable Area, Leasable Area below).

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

Why It’s Important to Understand Gross Leasable Area

Investors and tenants alike should have a good command of gross leasable area for multiple reasons.

First, GLA is one of the most common and easiest ways to project the potential rents of a property. Investors don’t have to worry about square footage lost to interior walls or common areas, which are often complicated and substantial. GLA is simply an easier way to calculate gross potential rent (GPR).

Second, most commercial leases are based on GLA. It’s historically been what GPR calculations, ROI calculations, and leases are based on. At this point, GLA is so embedded into industry practices that it’s impractical to change even if someone wanted to.

(GLA is much less often used when leasing multi-unit residential properties, where the number of units and square footage of units tends to be more common metrics. GLA is helpful in commercial and industrial settings, where tenants’ spaces aren’t uniform.)

How to Calculate Gross Leasable Area

The gross leasable area is calculated by a standard process that’s defined by the Building Owners and Managers Association (BOMA). The association sets international standards for measuring commercial and industrial buildings.

BOMA defines GLA as any rooms or portions thereof that can be leased or otherwise used to generate income. The standard way of measuring is to begin at the interior side of the exterior walls, measure, and include all space that meets the definition and details given above.

If calculating a tenant’s space, any walls within the tenant’s space are fully included in GLA. Any interior building walls that separate a tenant’s area from other spaces are calculated from the center of the wall so that half of the wall is included. This way, the tenant and building-wide calculations match up.

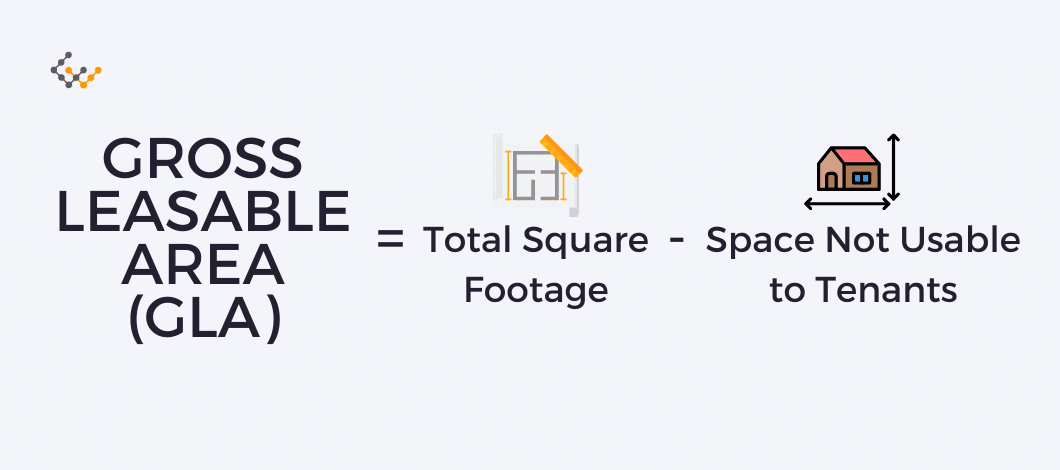

The more difficult aspect of calculating GLA is determining what space to include. The gross leasable area formula is simple once spaces have been properly categorized:

GLA = Total Square Footage – Space Not Usable to Tenants

5 Factors that Affect Gross Leasable Area

A number of factors can affect a property’s GLA, the biggest of which is the building’s size. The details that impact GLA are:

- Building Size: Larger buildings with more square footage almost always have more leasable space that can be included in GLA.

- Maintenance Areas: The number and size of a building’s maintenance areas affect GLA, as these areas normally aren’t included in calculations.

- Elevator/Stairwell Usage: How elevators and stairwells are used determines whether they’re included in GLA. The ones that customers and employees use are almost always included. Ones that are for emergency exits, maintenance, or other non-tenant purposes generally don’t get included.

- Basement Usage: How a basement is used determines whether it’s included in GLA. Basements that are solely for maintenance and storage that the building management uses shouldn’t be included. Basements that have space for tenants to use may be included, or at least part of them might be.

- Entryway Design: The interior space of entryways is included in GLA, but any exterior space isn’t. Buildings in different climates and with different architectural styles can have their entryways more or less closed in.

Gross Leasable Area vs. Rentable Area

The rentable area of a building includes the floor space that can be used by tenants. It’s highly similar to GLA, but typically excludes vertical partitions (e.g. walls, columns, etc.). Common areas are usually still included in rentable areas.

Gross Leasable Area vs. Net Leasable Area

The net leasable area (NLA) of a building is limited to the space that tenants have exclusive use of. It’s the actual square footage of their space that can be used. Vertical partitions, including those within a tenant’s space, and common areas are excluded.

Tenants should use NLA when planning how they’ll make use of their elapsed space since they can’t actually use the space where walls or other vertical partitions are.

Although tenants might feel as if leasing according to NLA would be more fair and accurate, this isn’t the industry practice because it’s more complex. If leases were based on NLA, property investors would likely just adjust their rent per square foot rates accordingly.

In some cases, net rentable area and net leasable area are used interchangeably. Thus, the same differences apply if comparing gross leasable area vs. net rentable area.

How to Use GLA in GPR Calculations

Gross potential rent (GPR) is one of the most common ways to calculate how much rent a building could theoretically generate. It’s calculated using gross leasable area, and price per square foot.

GPR = GLA x $/sq.ft.

For example, assume a 10,000-square-foot building has 9,500 square feet of space that meet GLA requirements. The building commands an average of $8 per square foot.

In this case, the GPR would be $76,000 (9,500 sq. ft. x $8/sq. ft.).

Wrapping Things Up

GLA is a foundational number that all property investors should know well. It’s important to know both how GLA is calculated, and what the GLA of any potential or currently held property is. Make sure this is one number that you’re always aware of — it’s easy enough to calculate.