Understanding Net Effective Rent in Commercial Real Estate

Rent is obviously the amount tenants pay for their leased spaces, but it can be calculated in a couple of different ways. Net effective rent calculates the amount that leases generate on an average monthly basis. Landlords may strategically use net effective rent in their listings and marketing, and they should know it even if they don’t advertise rent this way.

What Does Net Effective Rent Mean?

Net effective rent is the average amount of rent paid each month (or other payment period).

The net effective rent is equal to the gross rent when using basic leases that offer no promotions. When leases include discounted or free months, net effective rent takes into account these rent concessions. It calculates the average amount paid after any concessions are deducted.

Importantly, net effective rent isn’t necessarily the actual amount of rent paid. Most of the checks that tenants write are higher than the net effective amount, as the rent for all non-discounted months is higher than what’s paid after the discounted months are averaged in.

Landlords who offer concessions frequently only provide discounted months for tenants’ first leases. If no concessions apply when tenants renew, then the net effective rent can jump substantially.

(Net effective rent doesn’t represent the value of amenities offered. Features such as free internet reduce the effective cost of leasing spaces. These don’t impact rent calculations, including net effective rent, though.)

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

When Does Net Effective Rent Come Into Play?

Net effective rent is most important in renter’s markets, when landlords are more likely to offer free months, discounts for long-term leases, and other concessions. Anytime concessions are offered, net effective rent should be calculated.

Thus, the net effective rent may be used in both residential and commercial leases. Residential leases often have concessions during renter’s markets, off-seasons of seasonal locations, move-in periods for college towns, and when landlords lease large multifamily properties. Commercial leases for certain spaces, such as retail mall stores, are increasingly offering concessions.

When concessions are offered, both tenants and landlords should be aware of the net effective rent. Tenants need net effective so that they can accurately compare different properties’ rents when concessions differ, and so they can budget accordingly. Landlords need to calculate net effective rent so that they can accurately calculate revenues and profits on a monthly basis, as monthly numbers are used for loans, property valuations, budgeting and other purposes.

Of course, tenants and landlords shouldn’t mistake net effective rent with what’s paid each month. Tenants must be able to pay the higher monthly rent in non-discounted months. Landlords must be able to withstand a low-revenue months when concessions are used in highly seasonal markets (e.g. during August for college towns).

(Landlords of commercial properties ought to place any discounted months at the end of their leases rather than the beginning. Net effective rent doesn’t matter if businesses have a free month and then fail.)

How to Calculate Net Effective Rent

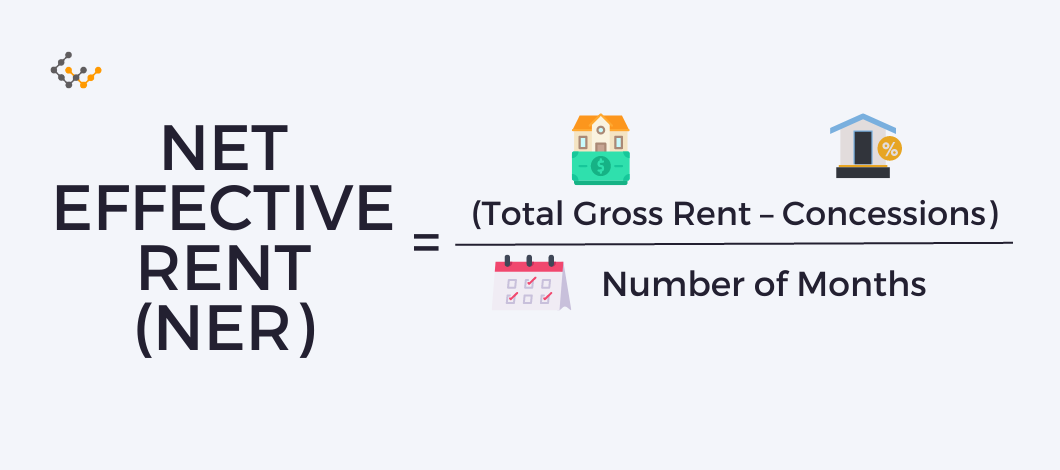

Calculating net effective rent is fairly straightforward. The total gross rents received throughout a lease are divided by the number of months that the lease lasts. If total gross rents aren’t known, they can be calculated by multiplying the gross rent (monthly rent) by the number of months, and then subtracting any concessions. The net effective rent formula is:

Net Effective Rent = (Total Gross Rent – Concessions) / Number of Months

Total Gross Rent = Monthly Rent x Number of Months – Concessions Value

Example of Net Effective Rent Calculation

Assume an apartment is leased for $2,000 per month, but tenants receive the first month free on an annual lease. The net effective rate in this case would be $1,833 per month.

Net Effective Rent of $1,833 = ($2,000 x 12 total gross rent – $2,000 concessions) / 12

For a more complicated example, assume the same apartment is leased for $2,000 per month. A particular tenant receives an additional 5% discount for signing a 24-month lease. The tenant also has two cats. Pets are an additional $100 per month, but the tenant receives a $25 discount on the second cat.

In this case, the net effective rate would be $2,401:

Total Gross Rent of $62,400 = ($2,000 monthly + 300 pet + 300 pet) x 24 months

Concessions of $4,775 = ($2,000 free month x .95%) + $2,000 x .05% discount x 23 months + 25 x 23 months

Net Effective Rent of $2,401 = ($62,400 total gross rent – $4,775 concessions) / 24 months

Difference Between Net Effective Rent and Gross Rent

There shouldn’t be a debate of net effective rent vs. gross rent, as both are useful. Neither one is better, and either can be used in listings. Landlords and investors should calculate both so that they have a more complete understanding of their property’s revenues.

Net Effective Rent

Net effective rent is the average rent that’s paid over the course of a lease. It takes into account any concessions or discounts offered, and is usually expressed as a monthly amount.

Gross Rent

Gross rent is the amount of rent that’s paid each month, when there are no concessions or discounts. This is reflective of how much must be paid in non-discounted months. It, too, is expressed as a monthly amount.

Total gross rent is the entire amount of rent that’s paid for the duration of a lease. Total gross rent is the figure used in most of the calculations above.

Wrapping Things Up

Commercial real estate investors need to be aware of net effective rent, so they can accurately calculate what leases are generating on an average monthly basis. For the most accurate and informative financials, make sure you know what the net effective rent of each unit leased in your properties is.