Understanding Mortgage Constant: Calculation, Formula and Applications

For real estate investors, understanding all of the numbers in any transaction is critical to determining if a transaction is worthwhile. Often, the focus is on determining if the return on investment is worthwhile, and that is often the case when costs are in line with earning potential. One specific area of focus is the cost of debt service. Mortgage constant is one of the resources you can use to determine this cost and therefore evaluate whether or not this transaction is worthwhile.

What is Mortgage Constant?

The mortgage constant is a figure that represents how much of the loan is being paid off on an annual basis over the entire course of the loan. This figure is only available for fixed-rate loans since the mortgage constant will change routinely with an adjustable-rate loan.

Another way to look at the mortgage constant often called the loan constant, is to consider it the calculation between debt service and the loan amount. The term “debt service” refers to money that is necessary to cover the payment of a loan, including both the principal borrowed as well as the interest on it. The debt service is calculated over a period of time.

How to Calculate Mortgage Constant

The mortgage constant formula is the annual debt service divided by the loan amount. To determine what this figure is, investors first need to understand what their debt service will be if they are obtaining a new loan or determine the current debt service on their existing loan. This is the cost of the monthly payment, the principal, and the interest paid on the loan.

It is then possible to calculate the mortgage constant by dividing this figure by the total loan amount.

Answer a few questions and get custom mortgage quotes. We'll match you with offers from our network of 650+ lenders.

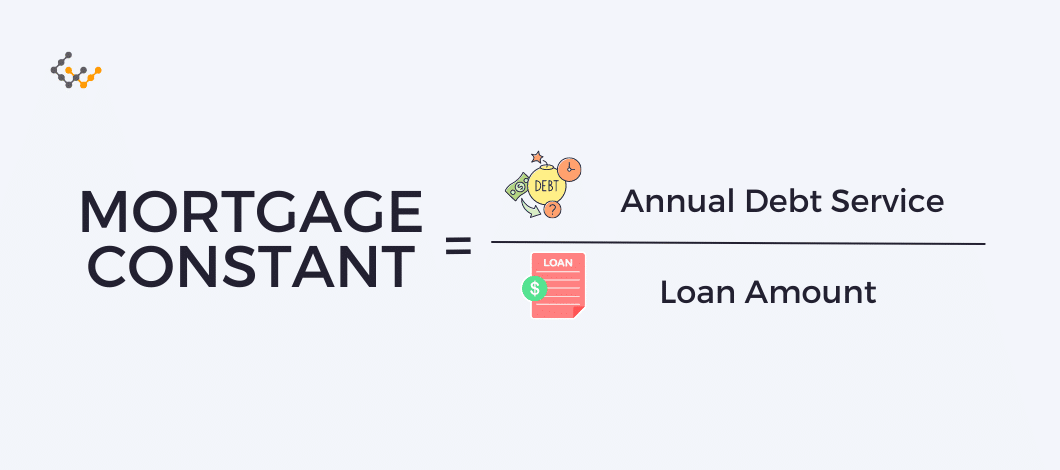

Mortgage Constant Formula

Mortgage constant = Annual debt service/loan amount

Examples of Mortgage Constant Calculation

These figures differ significantly from one loan to the next, but by plugging in the current loan terms, it may be easy to figure out what the mortgage constant is in a commercial transaction. Here is an example.

If a loan is a 20-year amortizing mortgage of 1,000,000, and it has an interest rate of 6 percent, then the loan’s debt service would be $85,972. That means that, in annual payments, the investor is paying $85,972 in payments that include both the principal owed along with the interest on the loan during that period.

To determine the mortgage constant, the investor would divide $85,972 by the total mortgage, which in this case is $1 million. This creates a loan constant of about 8.6 percent.

Mortgage Constant vs Other Property Investment Metrics

Mortgage constant is just one of the numerous financial investment metrics that investors must consider before making any decision to better understand their financial scenario. Consider the following valuable metrics, for example.

Mortgage Constant vs Debt Yield

The mortgage constant is a tool for investors to show if a property would be a profitable investment for their goals and portfolio. However, a debt yield is a different figure. It is just the opposite of what mortgage constant is. That is, it shows the annual income percentage based on the mortgage amount.

In situations where the debt yield is higher than the mortgage constant, that indicates that the property will have a positive cash flow. This makes it a positive, often profitable investment to add to a portfolio.

Mortgage Constant vs Cap Rate

The capitalization rate of a loan is another valuable figure. In situations where the investment property has a mortgage constant that is higher than the cap rate, is likely to be losing money. The property’s capitalization rate is determined by dividing the property’s net operating income by the market value. This can help to determine the value of a commercial property.

If the cap rate is equal to the loan constant, that means the investor is likely to break even on this transaction. In situations where the mortgage constant is lower than the cap rate results in a more profitable investment.

Mortgage Constant vs Interest Rate

In situations where the mortgage constant is considered against the mortgage interest rate, there are significant differences to consider. The mortgage constant is a figure that includes both the principal – the amount of the borrowed funds being repaid – along with the interest. Both components are used to determine what the mortgage constant is on an annual basis.

The interest rate on a loan does not do this. It simply provides for what the loan’s interest will be. It does not include the monthly principal that the borrower will pay over time. As a result of this, the interest rate is likely to be higher on an amortizing loan.

How Does Mortgage Constant Apply in Commercial Real Estate?

The mortgage constant is one of numerous metrics that investors and borrowers must take into consideration before making a decision to invest in a loan. It is important for numerous reasons. The main benefit is that it determines the amount of money the investor will need to have available to them each year to make payments on the investment.

The borrower, for example, is able to determine how much money they will need to have available for them to pay to cover just the loan’s costs throughout the year. If that figure is $50,000 and the company’s commercial investment property brings in $75,000, that means that it is a positive transaction.

This figure can help the borrower determine if they have the cash flow necessary from the commercial property to meet the profitability goals they have or to ensure the transaction is a worthy option for their needs.

It is important to note that this is just one component of the bigger picture. The mortgage constant is typically very easy to determine since it requires a simple calculation to determine what it is. And that information is typically readily available at the time of obtaining the loan. However, there are limitations to how this information may be applied in any situation.

For example, the mortgage constant is based on a fixed position in time. The loan amount is not going to change in this formula. However, that is not the case in reality. In fact, every time that the investor makes a payment on the loan, the loan’s mortgage balance drops as the principal is paid.

As a result, this may not be an accurate measure when considering very specific and limited transactions – it is necessary to consider additional factors as well.

Wrapping Up

When considering the investment in a commercial real estate property, investors must look at both the cost of paying for the mortgage on the property as well as the overall costs of operating it. This is critical in determining if a loan is worthy of investment or too expensive and, therefore, not within the specific guidelines the lender has.

Mortgage constant can provide insight into the profitability opportunities in any transaction, but it is only one part of a much larger figure. Investors should consider all factors when making a buying or investment decision to ensure their long-term profit goals can be met on a consistent basis.