How to Calculate Occupancy Rate: Formula and Calculation

Occupancy rate is a metric that helps real estate investors and managers assess a property’s performance and pricing. Here’s a guide to understanding occupancy rates for hotels and similar properties, including how to calculate it and what can be learned from it.

What is Occupancy Rate in Commercial Real Estate?

Occupancy rate is a standard metric used within the hotel industry, and it’s also useful in other settings where a property’s space is rented or leased. The metric expresses the proportion of available space that’s actively rented or leased.

Knowing occupancy rates enables investors and managers to make informed pricing decisions, calculate other metrics, and assess a property’s performance.

Why is the Occupancy Rate Important for Investors?

It’s something that investors with hotels, motels, inns, bed and breakfasts, and similar properties should know. It’s also important for office buildings, strip malls, standard malls, leased industrial properties, and almost anything else leased.

Knowing a real estate property’s occupancy rate can be helpful for:

- Pricing: Occupancy rate can indicate whether pricing needs to change. A low occupancy rate may indicate that prices are too high, while a high occupancy rate might indicate prices are lower than they need to be. This can be especially helpful when used with revenue per available room (RevPAR).

- Marketing: If prices are consistent with other properties in the area, the occupancy rate might indicate how effective a marketing strategy is. A low rate could be due to poor marketing, while a high rate might suggest that marketing is going exceptionally well.

- Performance: Tracking occupancy rates over time, such as months or years, shows the general trend of a property. If there’s any notable increase or decrease, investors can then evaluate what factors likely contribute to the movement. A decline might be due to building age, in which case a remodel might boost occupancy. Trends could also be due to strategic changes, industry factors, local trends, or other details.

- Other Metrics: Other metrics, including RevPAR

- Valuation: Occupancy rate is one metric used when valuing a property. It can also be useful when assessing what potential a property has to grow revenue.

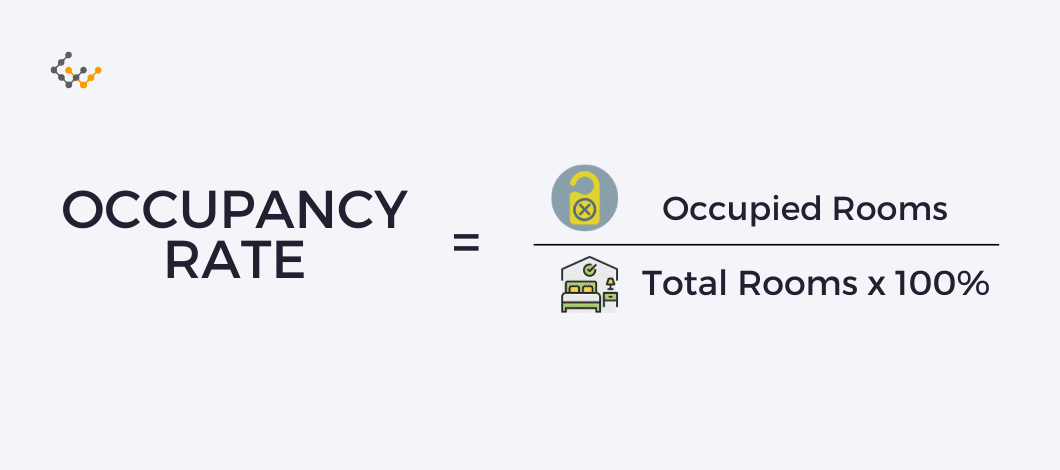

The formula for Calculating Occupancy Rate

Occupancy rate is one of the easiest commercial real estate metrics to calculate. It’s simply the number of occupied units divided by the number of total units (times 100 for a percentage).

Occupancy Rate = Occupied Rooms / Total Rooms x 100%

If not in the hotel industry, then rooms should be replaced with units.

The size of a unit isn’t taken into account. For example, consider a hotel that wants to know its one-night occupancy rate. It would divide the number of rented rooms, by the total number of rooms in the hotel. Whether the rooms were standard rooms, suits or something else isn’t factored into the equation.

Average Occupancy Rate for Different Types of Commercial Real Estate

The average occupancy rate as of March 2022 for U.S.-based hotels was 63.2 percent, according to STR. The American Hotel & Lodging Association (AHLA) projects hotels to have pretty flat rates for 2023, expecting the year’s average occupancy rate for hotels to be 63.8%. When motels and other similar properties are taken into account, the rate can drop slightly to 55%. Hotels in most other countries tend to have slightly lower occupancy rates.

For other properties, the average occupancy rates are as follows:

- Resorts: Average occupancy rate is 70%

- Apartment Complexes: Average occupancy rate is 88%

- Retirement Homes: Average occupancy rate is 85%

How to Calculate Occupancy Rate for an Apartment Building

An apartment building would calculate its occupancy rate following the standard formula but using units rather than rooms. Only units would be included. Any additional rented items, such as parking spaces or storage sheds, that are an extra fee would be excluded from the occupancy rate.

As an example, consider an apartment building with just 20 units that’s located in a high-demand area. If the apartment building had all units except for 1 leased, its occupancy rate would be 95% (95% = 19 leased units / 20 total units x 100%). This rate might be fairly stable year-round.

A large apartment complex located adjacent to a college could have a very different occupancy rate. Assume the complex had 100 student apartments and could lease all of them using a 9-month lease that lasted the academic year. The apartment might have 4 students move out after the fall semester, breaking their leases. For summer, only 60 apartments might be leased.

For this student housing example, occupancy rates would be 100% at the start of the fall semester, 96% during the spring semester, and just 60% during summer. The complex might consider moving to 12-month leases so summer occupancy increases, but this may decrease occupancy rates during the semesters.

How to Calculate Occupancy Rate for Hotels

Properties within the hotel industry, again, follow the same formula to determine occupancy rate. For instance:

- A typical hotel in a large city might want to know its occupancy rate for the month (30 days). If the hotel has 100 rooms and booked 70 on average each night, its occupancy rate would be 70% (70% = 70 booked rooms / 100 total rooms x 100%).

- A small B&B might want to know its occupancy rate for the year and only have total rooms booked as an easily available metric. If the B&B has 4 bedrooms, it’d have 1,460 rooms available during the year. If 950 rooms were booked, the occupancy rate would be 65.1% (65.1% = 950 booked rooms / 1,460 total rooms).

- An older motel in a highly seasonal location might want to know its occupancy rate for February. Assume the motel has 30 rooms, which would equate to a total of 840 available rooms during the month. If only 294 were booked during February, then the occupancy rate would be 35% (35% = 294 booked rooms / 840 available rooms x 100%). In this case, the owner might decide to take much of February off.

What Factors Affect Occupancy Rate of a Property?

Many factors can have an impact on a property’s occupancy rate. Just a few include location, property condition, market trends, and economic factors, and there are plenty of other influences. Pricing is one of the factors that most directly impact occupancy rate and that hotels have the most direct control over.

Occupancy Rate vs Vacancy Rates in Commercial Property

Occupancy rate and vacancy rate measure essentially the same metric, except each approaches it from a different perspective. The occupancy rate shows how many units are being rented or leased, while the vacancy rate shows how many units aren’t rented.

The vacancy rate is calculated as the number of unrented units divided by the total number of units.

Vacancy Rate = Unrented Units / Total Number of Units x 100%

3 Tips to Improve Your Occupancy Rate

To increase a property’s occupancy rate, you might:

- Price: Lowering the price of rooms can increase the occupancy rate, as customers are attracted by better pricing.

- Marketing: Revising a marketing strategy so that it more effectively reaches the target consumer could yield a better occupancy rate.

- Upgrades: Updating a hotel or other property with newer amenities and features may increase occupancy.

Wrapping Up

Being able to understand and accurately calculate occupancy rates is essential if you’re investing in hotels or similar commercial real estate. Use this metric to evaluate better pricing, marketing, and other factors about your potential or held properties.