How to Calculate MIRR: MIRR Formula and Examples

Commercial real estate investors need as much information as possible when deciding what to invest in and how to do so. Numerous types of financial data are available to allow for that, including modified internal rate of return (MIRR). This specific metric enables investors to determine if a property is a good investment or one that carries too much risk. Therefore, understanding this metric is essential.

What is Modified Internal Rate of Return (MIRR)?

Modified internal rate of return is a more reliable calculation than the once-used internal rate of return. A MIRR that is higher than the expected ROI is the ideal opportunity for most investors. One that is lower indicates that the investment may have limited potential.

Most of the time, investors use MIRR as a way to compare more than one investment opportunity to each other. This allows the investor to determine which offers the best MIRR and the best long-term opportunity for returns.

MIRR focuses on the positive cash flow reinvested into a project. It improves the IRR calculation that has been used routinely over time. It provides an estimate for the ROI using valuable data that stems from multiple years of a project rather than a single figure. This ultimately offers a better solution that is more accurate for investments.

Why is MIRR Important?

MIRR is used in capital budgeting for investments. It allows for the identification of how viable a project may be. When the MIRR is higher than the expected return on the project, that indicates an attractive investment. An MIRR that is less than the expected return may indicate the project is less beneficial to the overall profitability of the project.

MIRR is effective, particularly over IRR, because it uses data from previous years on a project. This allows for the creation of a single figure that can be used to analyze the benefit of any project. As a result, MIRR provides more reliable information than IRR.

How to Calculate Modified Internal Rate of Return (MIRR)?

To determine the MIRR, it is necessary to consider three key factors:

- The future value of positive cash flow discounted at the reinvestment rate

- The current value of negative cash flow at the financing cost of the company

- The number of periods for the investment

MIRR Formula and Calculation

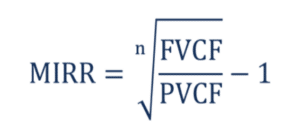

The following is the MIRR formula used.

In this equation, the following apply:

- FVCF: This is the future value of positive cash flow that’s discounted at the reinvestment rate

- PVCF: This is the present value of the negative cash flows that are discounted at the financing rate

- N: This is the number of periods.

While you certainly can calculate MIRR after gathering all of this data and applying the information to the formula, it is a long and tedious process that may not be beneficial to all people (the fact is, this calculation is complicated and prone to errors that can provide an inaccurate view). If possible, the better option is to use an MIRR calculator to help with the process.

MIRR Example and How to Use It

Consider how MIRR works.

Assume Main Street Investors want to determine if investing in a second manufacturing facility would be beneficial to their operations or not worth the cost. They determined that they needed to spend $200 million to build the plant. The cost of capital for this is 10%.

They also determined that the plant would likely generate an additional $50 million in generation of their production in the first full year it is in operation. After that point, they expect to ramp up production to reach twice as much, $100 million in the second year, and three times as much in the third year at $150 million.

To calculate this figure, the first step is to determine the future value of positive cash flow that is likely at the reinvestment rate. In this situation, we can assign the company’s cost of capital to this figure.

The second figure is the present value of negative cash flows at the discounted financing rate. In this example, that is $200 million.

Applying the formula here, the MIRR for the project is 17.02 percent. That figure alone is not necessarily enough for the company to make a decision, though. Typically, it becomes necessary to compare the project’s expected return to other projects and opportunities to determine which project may be better for the company’s goals and objectives.

How is MIRR Different from IRR?

IRR, or internal rate of return, is similar in concept to MIRR. In fact, MIRR was developed to overcome the limitations of IRR.

IRR is considered a flawed assumption. The difference with it, and why it is no longer readily used, is that it assumes there will be a positive cash flow that will then be reinvested at the same rate. More accurately, in most situations, MIRR uses an external rate of return. This allows for a more likely and reliable figure.

Also notable is that IRR typically provides the user with two solutions. That means that, even with other information, the user still does not have a clear decision. There is still some level of ambiguity, and that level of uncertainty is problematic to all investors. MIRR provides one answer, one solution, so to speak.

This means that it is very clear which ROI is the better opportunity for the company. Notably, IRR tends to be higher than MIRR, but MIRR offers more accuracy. Even if the IRR is the actual reality of the project, it is typically better for the investor to have banked on the lower figure of MIRR instead of planning for the higher figure and missing the mark with IRR.

Are There Limitations in Using MIRR?

Overall, MIRR is a very helpful, impactful tool that allows investors to have a solid amount of information when comparing projects to determine which investment is truly the best option for their financial goals. It allows investors to compare two projects that may be very unequal investments in an even light. More so, investors can alter the assumed rate of reinvestment growth of the project at every stage.

There are some limitations to using this figure, as there are with all types of investment metrics. For example, the biggest obstacle is that you must use estimates and assumptions. That means that the result and calculation provided are ultimately dependent on how accurate those estimates are. There is no way to be fully confident in any of these investments, though, which is why MIRR is often considered a reliable option overall.

Wrapping Up

The MIRR calculation is a valuable tool most investors should use when comparing two projects to each other when those projects are of unequal size. It eliminates the most common errors in the traditional IRR calculation process, which allows for a more accurate representation of the opportunities a project can offer.

Though the MIRR calculation is available and can be applied, it may be easier to use software and MIRR calculators to help plug in all of the necessary data to determine what the MIRR is for any given project. Doing so ensures more accuracy in the long term.