What is Before Tax Cash Flow (BTCF) in Property Investment?

Before tax cash flow (BTCF) is a metric all commercial real estate investors must understand. It provides an analysis point that can be essential in understanding the potential cash flow a property can produce. It is one of numerous metrics considered before investing in real estate.

Understanding Before Tax Cash Flow (BTCF)

BTCF represents the cash flow the real estate investor will attain after paying all loan payments and operating expenses on a property. It provides the property owner with insight into what the return on equity (ROE) is. Specifically, ROE is the income return the investor receives, with equity referring to the funds the investor has put into the property’s purchase.

Before tax cash flow is the amount of money the property will produce once all payments are made, including operating and debt service. The critical difference in determining this type of cash flow is that it is a calculation that occurs prior to consideration of any income tax liability that the investor owes. It also does not include some types of losses, including depreciation of the property, non-cash items, or any of the mortgage interest paid.

Also called pre-tax cash flow, this figure is a valuable analysis point before purchasing property. However, it can be determined anytime if the information needed is available.

How Do You Calculate Cash Flow Before Tax?

To calculate before-tax cash flow, all net operating income is calculated. This includes all revenue the property produces. Then, the debt service, such as loan payments, is subtracted from this. All operating expenses are also subtracted from the net operating income. The remaining figure represents the property’s pre-tax cash flow.

Taxes differ significantly when it comes to not just property but also the investor. For that reason, this figure is not included in this calculation.

Formula for Calculating Before Tax Cash Flow

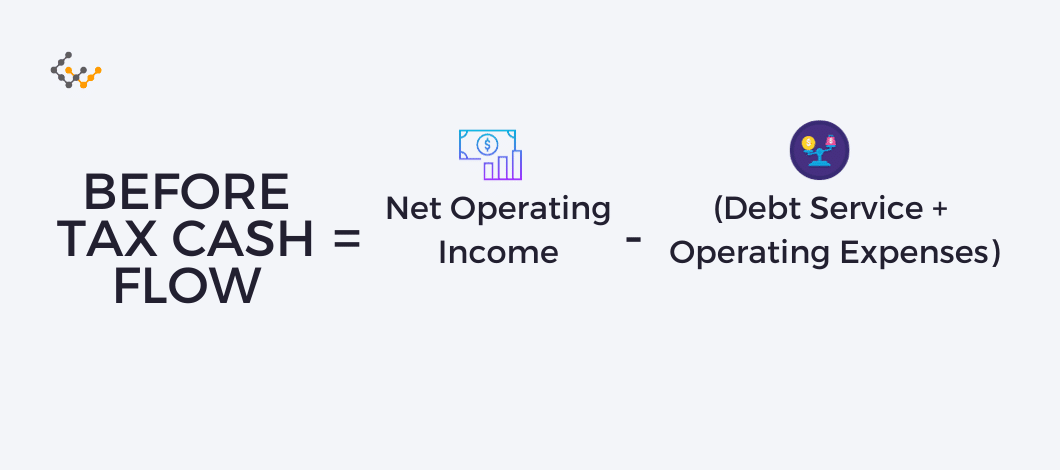

The specific formula for BTCF is:

Before Tax Cash Flow = Net Operating Income – (Debt Service + Operating Expenses)

Example of How Before Tax Cash Flow is Calculated

A property investor may be considering an investment property. The project is a multi-family condo community that has 5 units. The investor purchases the property with a loan of $500,000. It has an interest rate of 7%. The loan will last for the next 20 years.

In this situation, the property investor needs to determine how much cash flow he or she will have when considering the revenue from the property (paid through rental payments) after all of the loan payments and the operating expenses are factored into the process. Consider that, in this situation, the property investor obtains $10,000 per month in rental income from the units. The property has $4,000 worth of operating expenses. The loan payment for the property is $3,500.

In this situation, the net operating income for the year is $120,000 (5 units at $2,000 a month each, for $10,000 per month). The operating expenses for the property are $48,000 ($4,000 per month for 12 months). The loan payment or debt service for the year is $42,000 annually ($3,500 per month for 12 months).

In this situation, the following is determined:

- The total cost with just these figures is $90,000 ($42,000 + $48,000).

- The revenue from the property is $120,000 – expenses of $90,000.

- The BTCF is $30,000

It is important to note that numerous factors are not included in this very basic calculation. That includes:

- Vacancy and collection losses from the property

- Changes in costs year-to-year

- Changes in rental income year-to-year

- Loan terms and adjustable rate (if applicable)

- Other costs

More complex versions of this formula for BTCF could factor in full net operating income (which includes rent as well as other revenue generated by the property) as well as vacancies and collection losses.

Positive vs. Negative BTCF

BTCF is an important metric for many organizations, especially for investors who need to ensure their investment is going to yield a positive cash flow right away. While it may not be comprehensive, this metric can allow investors to compare one or more properties to each other to determine which is the best suited for their specific needs.

BTCF benefits include:

- Calculate a return on investment easily since most data is typically available

- Allows for equal comparison of property no matter what the taxes are for one area to the next

BTCF limitations include:

- Does not factor in costs related to taxes, which may vary from one area to the next, making some properties less desirable

- Can be limiting if not all factors are included

As noted, this is one metric out of many that investors use to determine if they should put money into a specific project. It is not the only factor to consider.

5 Ways to Increase Your Cash Flow as an Investor

Investors can maximize the use of their cash in numerous ways. The most important decision is purchasing profitable properties, those already earning a positive cash flow. If that is not possible, investors will need to get creative in building up cash flow to make the investment a worthwhile decision. Some methods to do that include the following:

- Improve the quality of the property to raise rents. This must be done with careful consideration to market rental rates in the area so as to avoid pricing out the property from would-be renters in the region.

- Negotiating the lowest possible cost of the loan. This is a critical factor for today’s investor, who is looking for the least risk. For example, choosing a slightly lower interest rate may help lower monthly debt service. However, it is critical to consider the cost of refinancing existing loans.

- Put more cash into the purchase and borrow less. Though this increases the investor’s personal risk in the property, it may help to reduce debt service significantly, even if just a percentage point or two more than the initial down payment.

- Build-in added revenue sources in the property. This may be done inexpensively, such as by charging for parking or laundry services onsite or charging a fee for recreational services available. For larger-scale returns, consider adding additional units to the footprint or adding additional profit centers such as an onsite business or service solution.

- Look for ways to reduce operating expenses. This may include passing some of those expenses to renters or negotiating better terms.

Companies must take into consideration taxation and code restrictions in these areas as well. In some situations, rental costs are too low, and increasing them to match the market could help to improve cash flow right away. In other areas, companies may need to be creative, such as renting out storage space or adding to the property’s amenities.

Wrapping Up

Before tax cash flow is a valuable metric investors can use to determine where they sit when it comes to investment opportunity and cash flow availability. Though not the only metric that is necessary to consider, it is one that can help investors consider the value of investing in one property or another, as well as taking steps to increase the worth or value of the project to yield a higher level of revenue.